Gsa Travel Rates

General Services Administration GSA the authority to establish the system of reimbursing Federal employees for the subsistence expenses lodging meals and incidentals of official travel. The current continental US.

San Diego S Government Per Diem Rate Recalculated To 139 For Fy14 Sdta Connect Blog

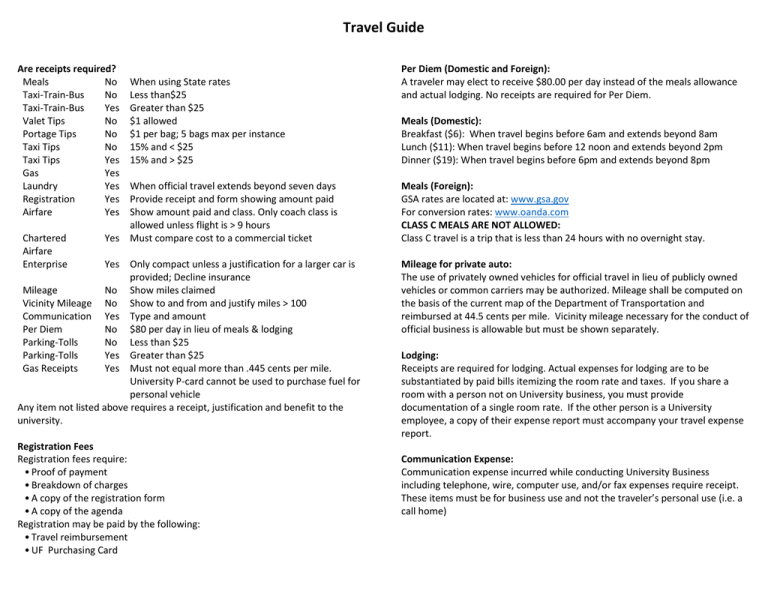

In-State or Out-of-State Meals and Lodging.

Gsa travel rates. The General Services Administration has issued the fiscal year 2022 per diem rates for federal employees who travel for work. The General Services Administration GSA has issued the 2021 per diem rates and GSA mileage rates for 2021 in Notice 2021-02. Yes a traveler receives 75 percent of the applicable MIE rate for the day of departure from the permanent duty station and the.

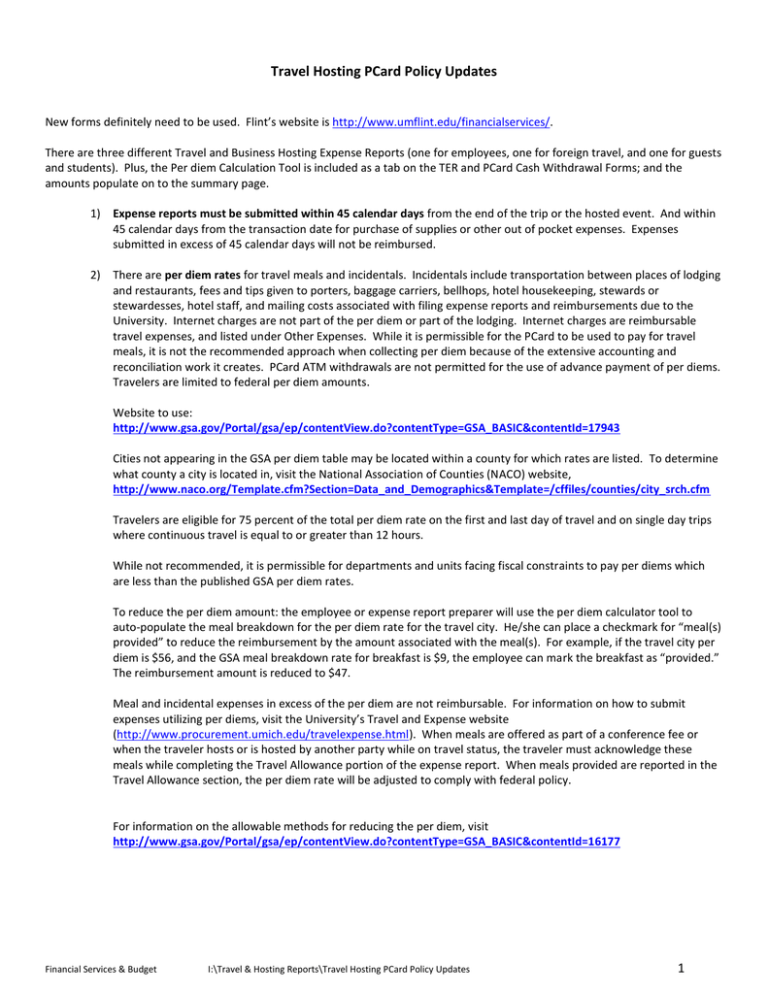

These per diem rates specify the amount of monetary reimbursement to be provided to government employees and employees of private organizations which use GSA per diem rates who are travelling on business to various areas. EmployeesStudentsGuests can use the GSA site see box immediately below for rates for the 48 contiguous United StatesIf you are not an employee and need rates for. The 2021 GSA mileage rate is 56 cents per mile down 15 cents from t he rate for 2020 mileage which was 575 cents per mile.

If the city is not listed but the county is listed use the daily rate of the county. Use the Per Diem and Lodging Rate document as a guide. Entering the first letter of the country name will jump to that portion of the listing.

FY 2020 Per Diem Rates apply from October 2019 - September 2020. Federal employees who use their personal vehicles for work will be glad to see that the new mileage reimbursement rates are higher this year than last year. In the simplest terms the GSA is like a service hub for the federal government.

Federal per diem rates are set by the General Services Administration GSA and are used by all government employees as well as many private-sector employees who travel for their companies. You may drive no more than 400 miles a day. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate.

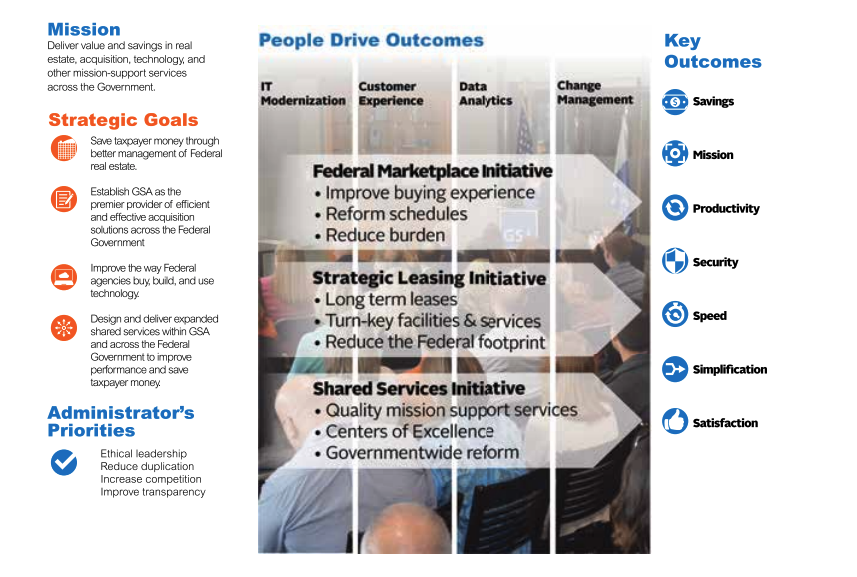

The GSA is a huge government agency with many responsibilities. The reimbursement rates for 2019 are 058 per mile. The GSA General Services Administration sets per-diem rates for destinations within CONUS the Continental United States.

Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Any amount over the GSA maximum for a location will be considered income and taxed as such. 50 rows GSA Travel Rate 2020 A per-diem is a set quantity of cash offered to.

CONUS rate is 91. GSA Travel Rate 2021 A per-diem is a fixed quantity of cash given to staff members to deal with day-to-day expenditures like meals lodging expenditures and also various other subordinate expenditures which arise while one is on official obligation. Does a traveler receive a different meals and incidental expenses MIE rate for the first and last days of travel.

STANDARD CONUS RATE RESERVE COMPONENT ALABAMA ARKANSAS ARIZONA CALIFORNIA COLORADO CONNECTICUT DELAWARE DISTRICT OF COLUMBIA FLORIDA GEORGIA IDAHO ILLINOIS INDIANA IOWA KANSAS KENTUCKY LOUISIANA MAINE. Per Diem Rates Query. The GSA updates travel per diem rates annually and rates are effective October 1 at the start of each fiscal year.

Clicking Go will display Per Diem data for all locations within the country selected. Per Diem - First and Last Days of Travel. They have developed standard travel rates for government as well as non-government employees including travel nurses.

The GSA rate is the maximum amount allowable tax-free by location for work related lodging meals and incidentals. GSA establishes per diem rates for destinations within the continental United States CONUS. View summary of changes.

The law governs how GSA sets rates today and allows the GSA Administrator to establish locality-based. Refer to the GSAs federal Domestic Maximum Per Diem Rates effective Oct. If you are accepting GSA tax-free amounts from your travel nurse agency its important to note that you cannot also receive agency.

GSA Announces Fiscal 2022 Travel Per Diem Rates The per diem for lodging will remain at fiscal 2021 levels next year due to the downturn in hotel. 1 Standard Mileage Rate is used for travel in a Personally Owned Automobile POA when a government owned vehicle is not available or not in the governments best interest. To calculate the per diem qualification the agency will typically have you complete a form based on a formula established by the federal General Services Administration GSA.

Employees can use Chrome River to determine Per Diem and Lodging rates for ALL locations US. And InternationalNOTE that only employees have access to Chrome River. In 2018 they were 0545 per mile.

Travel GSA abbreviation meaning defined here. For travel farther than 400 miles you must use commercial air-travel. If a uniformed military member or a Department of Defense DoD federal civilian has questions regarding the adequacy of per diem rates they can contact GSA.

Per-diems are fixed amounts to be used for lodging meals and incidental expenses when traveling on official business. GSA Increases Mileage Rates for 2019. Get the top GSA abbreviation related to Travel.

You may use the dropdown box below to select a country. Per diem ratesthe allowance for lodging excluding taxes meals and related incidental expensesare regularly reviewed and adjusted according to market conditions. Current Rates Fiscal 2022 Travel Reimbursement Rates Employees.

While the meals and incidentals rates were revised the lodging rates have been frozen at the 2021 levels because of the COVID-19 pandemic. 5 USC 5702 gives the Administrator of the US. Normally the rates are updated at the beginning of each new fiscal year.

What does GSA stand for in Travel. 2 Government Vehicle Available Rate is given when use of a government owned vehicle is available but the. What Are GSA Rates and How do They Pertain to Travel Nursing.

Foreign Per Diem Rates by LocationDSSR 925. Per diem rates by the Federal Government are usually set by the GSA General Services Administration. GSA is the acronym for the General Services Administration of the United States Government.

Gsa Releases Fy 2022 Per Diem Highlights Fedmanager

What Happens When Government Per Diems Change Hotel Online

Top 10 Most Expensive Us Business Travel Cities And Their Gsa Per Diem Rates Sap Concur

Guide On Per Diem Meal Expenses Travelperk

Top 10 Most Expensive Us Business Travel Cities And Their Gsa Per Diem Rates Sap Concur

Travel Hosting Pcard Policy Updates

Ahla Aahoa Support Act Stabilizing Gsa Per Diem Rates Hotel Management

What Happens When Government Per Diems Change Hotel Online

What Is Per Diem Rate And How To Set It Per Diem Rate Table Us

6 Things Travel Nurses Should Know About Gsa Rates

6 Things Travel Nurses Should Know About Gsa Rates

International Per Diem Rates Travelperk

Gsa Selects Eight Carriers For Potential 2 25b Federal Passenger Transport Program Govcon Wire

All You Need To Know About Per Diems In The Us Itilite Blog

Per Diem Rates Military Government Travel

Post a Comment for "Gsa Travel Rates"